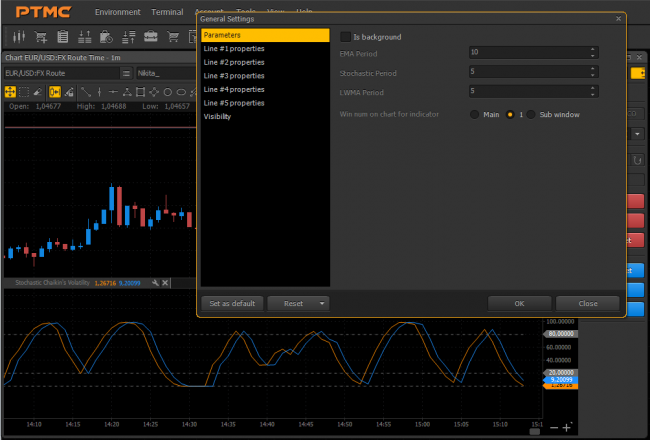

Stochastic CHV Indicator

As a basis, Chaikin's Volatility (CHV) Indicator calculates volatility of oscillation of the spread inside the difference of minimal and maximal prices. At the same time, it doesn't look like Average True Range (ATR) because gaps are neglected by given one. Attaching to given indicator a stochastic behavior brings us to an interesting variation that could improve results and raise profits in market affairs.

Files

04.01.2017

04.01.2017

4

4

Discussion

Join PTMC community to post your comments

No comments yet. Be the first.